Makers of Fake Money Claim it is a Crime to Use Real Money

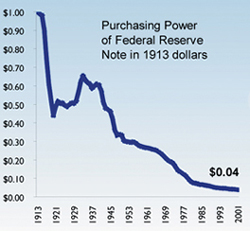

The fiat currency circulated by our government has lost 96% of its purchasing power in one life time. I can remember when bubble gum was 1 penny each. Now it is a nickel each. In terms of bubble gum, our currency has lost 80% of its purchasing power in my lifetime, and I am only in my 40's.

Our constituion says that no STATE shall coin money, nor shall they make any money legal tender (meaning you HAVE to accept it in trade) unless the money is of gold or silver. The Founders developed a strong dislike of unbacked paper currency, much like that which our government is now issuing. The Constitution says nothing about private groups being prohibited from coining money, which individuals can then use in trade of their own free will.

One group, the makers of Liberty Dollars, have done just that. They make coins containing silver, or give out certificates backed by silver sitting in a vault. Paul Harvey runs ads for them. There are millions of liberty dollars in circulation, and the feds don't like it. They claim the use of Liberty Dollars "is a crime", but don't get around to saying why it is a crime for people to barter using something of real value as a medium of exchange rather than the intrinsically worthless paper dollars that our government is filling the earth with.

If the government won't use an honest currency itself, you would think that the least it could do is let other people use an honest currency. But no, even that level of decency has departed from our ruling class in Washington.

14 Comments:

What's in your wallet?

Seriously, I've heard about Liberty Dollars, and the concept of returning to precious metals-backed currency sounds interesting. But how could we ever do that so long as we're forced to take Federal Reserve Notes as payment? If I were a merchant, I could buy all my goods, at wholesale, in Liberty Dollars (assuming my suppliers accepted them), but my customers could take them from me by paying in FRN's. And by law, I have to allow it. How can this work?

There is an economic law that says "bad money drives out good". That is, people will hoard real money and use paper money when they are both by law valued the same. But that is not the case here. The value of the Liberty Dollars should go up and down with the value of the silver in them. That is true of the coins. The notes are tied to a specific dollar value of silver as I understand it, and if so are no protection against inflation.

The notes are tied to a specific dollar value of silver as I understand it, and if so are no protection against inflation.

FRN's? They're tied only to the whims Ben Bernake! The Feds use inflation as a tool to pace our economic activity.

Maybe I'm not understanding what you're saying...

To make myself more clear, I was referring to the "silver certificates" that the Liberty Dollar people sell along with their silver coins, not federal reserve notes. Those are, as you point out tied to the whims of the Federal Reserve. They are backed by nothing except the "full faith and credit of the United States Government" - whatever that is!

Oh, I see. Well, backing up a point, I suppose I'm stuck n the law you referenced: "bad money drives out good". I don't see why that doesn't apply to the LD scheme.

That law is true when the government artificially sets the real money (say a silver dollar) to the same value as a fiat dollar (a paper unbacked dollar).

When that is the case, people will hoard the silver dollars and spend the paper because they know the sliver dollar is more certain to hold (and possibly increase) its value. The cumulative effect of the whole population doing this is that real money soon disapeers from circulation. It is hoarded by people as a form of security.

The reason it does not apply to Liberty Dollars is that the government is not forcing people to accept them at the same rate as a paper dollar. There is no law in place that would prohibit a business owner from saying, "I will take $100 for that chair, but I will sell it to you for 95 liberty dollars".

What will keep the silver coins in circulation is that they are not denominated by law as being equal to a dollar so the value of the coins is free to go up to true market value, keeping them in circulation.

So, back to my merchant scenario, I list the price of a widget that I'm selling as $X or $LD1. But, I still must take the $X dollars FRN if I don't want the federal government to close me down. Are you simply saying that I need to adjust the value "X" in order to compensate for the FRN's inflation relative to the $LD1?

If so, what standard should I use to achieve this, since-- as you agreed-- the standard of the USD is whatever the Fed says it is?

Wow

Before you talk about the inflation rate of our currency maybe you should weigh the benefits of the gold standard during the 1800s when there was so many fortunes were won and lost because of the incredibly high levels of volatility. Inflation isn't bad, especially when it is predictable. What caused the depression -not inflation but poor judgement calls by a FED that was largely appointed because they were frinds of the powerfull. That is not the case today.

3:53

Merchants around the world did what you suggested when the dollar was stable or strong. THey would have a price for their goods in say, Romanian currency and another price in dollars. Over time inflation would force them to raise their prices in the Romainian currency but not in dollars. They would give you a dollar price that was better than the official "exchange rate".

Sustained inflation is terrible. We have only been able to get away with it because the world has used the dollar as a reserve currency. If they ever stop, there will be a dollar dump so extreme that it will take 1000 dollars to fill your gas tank.

Yes, our currency is "predictable", it is predictable that it will become increasingly worthless. As soon as people figure that out we are in trouble.

For once, I completely concur. Mark, you are spot on with the hyperinflation scenario. Once the world figures out that the Euro is a better Reserve Note (because the U.S. is close to bankrupt) you will have to spend your money as quickly as you get it. This will only add fuel to the fire as we drive up inflation even faster with our $100.00 loaves of bread.

Do you know how inflation is controlled?

Do you know that it is controlled and also that most economists prefer a small level of inflation?

If there was a 0% inflation rate or worse deflation then our capital market would sink like a stone. The reason the world uses our currency is because they have access to the most efficient capital market in the world. The only one that comes close is the UK's.

The world uses our currency because it's OPEC's trade currency. In other wordes, we currently have an oil standard.

How do you explain the point of this article which is that the dollar has lost 96% of its value over our lifetime? Is that "efficient" to you?

The world uses our currency because it was the most stable around after WWII and at the time we were the world's largest creditor nation. Now we are the world's largest debtor nation and our currency is grossly over-extended.

Most economists work for politicians, that is why they think a little inflation is good. Dumping a few bales of fake money out there keeps the illusion of prosperity going just a little bit longer. Of course it also insures that the correction will be worse when it comes, but why worry about things past the next election cycle?

And our capital market would not sink like a stone if it were the right kind of deflation. There is debt-induced deflation and efficiency-induced deflation. And example of the former, which we are at risk for, is when everyone is so in debt that they simply have no money to buy and their credit is tapped out. That is a disaster. Factories sit there unused. Workers get layed off. And the cycle just continues. THAT is bad deflation, and it is caused by excess debt.

The other kind of deflation is efficiency-induced deflation. It is caused by mankind finding better ways of doing things while the money supply is held constant. That kind of deflation is not bad, it is a great blessing. Imagine if someone discovered a way to turn oil-shale and tar sand into oil for $15 a barrel on a massive scale with little start up costs. Gas prices would plummett. Transportaion-intensives prices would go down too. The same number of dollars would buy more goods and services. That is deflation, but it is good deflation. Why shouldn't we want a situation where our same dollar, our same salary, buys more and more goods and services? That means our standard of living goes up! Give me efficiency-induced deflation any day over deliberate inflation and credit creation that will ineveitably lead to debt-induced deflation.

In debt-induced deflation, dollars will buy more too, but you don't have any dollars because everyone is too in debt to buy any more of your company's products so they had to lay you off. In efficiency-induced deflation your company can sell the same product for 20% less so people are buying more of it. Your job is secure, and since everyone else is also finding ways to make their products for 20% less it is like you just got a 20% raise! THAT should be our goal, but that is not even the direction our government is aiming for.

Post a Comment

<< Home